Investing in real estate provides a distinct combination of stability, tangible assets, and consistent long-term appreciation. Historically, real estate has demonstrated steady value growth over time. While market fluctuations may occur, well-selected properties tend to follow an upward trajectory. This gradual increase in value can generate significant wealth over time, offering a dependable path to financial security.

Real estate, particularly private real estate, has historically exhibited a low correlation with stocks and bonds, making it an effective diversifier in investment portfolios. By incorporating real estate, you can reduce risk and minimize exposure to market volatility. Unlike stocks, real estate values tend to be less influenced by stock market fluctuations, allowing property investments to perform well even during periods of market instability.

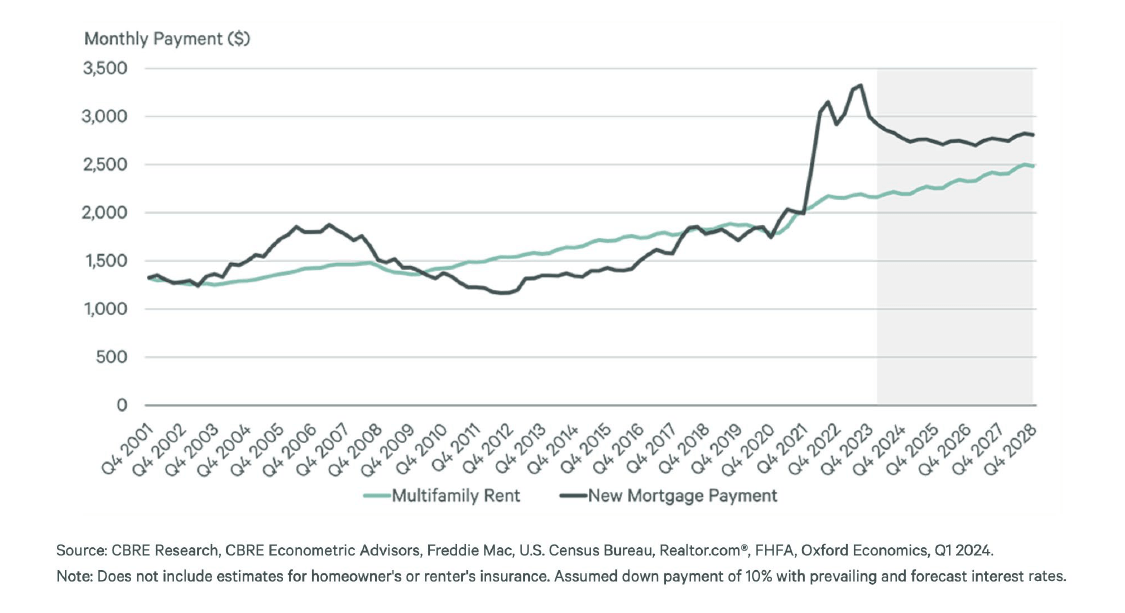

We believe the multifamily sector offers a robust hedge against inflation, delivering attractive risk-adjusted returns. Additionally, investing in real estate provides notable tax benefits. Deductions for mortgage interest, property taxes, and depreciation can significantly lower your tax liability, ultimately enhancing your overall return on investment.

Investing in real estate provides a distinct combination of stability, tangible assets, and consistent long-term appreciation. Historically, real estate has demonstrated steady value growth over time. While market fluctuations may occur, well-selected properties tend to follow an upward trajectory. This gradual increase in value can generate significant wealth over time, offering a dependable path to financial security.

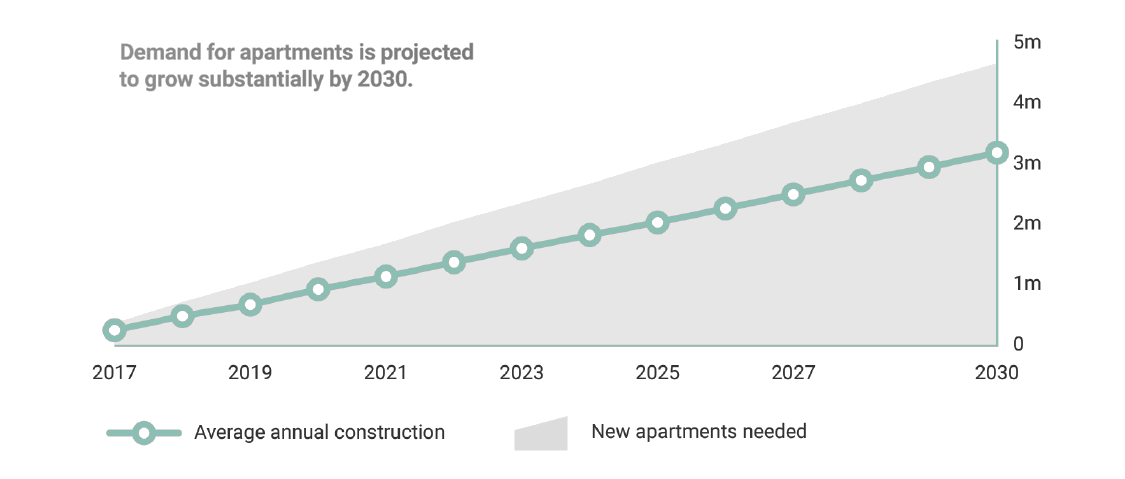

The data now shows a need to build at least 4.6 million new apartments by 2030 to meet the expected increase in demand for housing; otherwise, the affordability problems that exist today may get worse.

Address

29 S. Trooper Road

Suite 100

Norristown, PA 19403

Call Us

Email Us